April is Financial Literacy Month! Do the following financial terms ‘budget’, ‘savings’, and ‘expenses’ make you want to quit reading and avoid this topic altogether? If so, then please keep reading because this blog post is definitely for you and applicable for everyone. You work hard to earn that money! Knowing where each penny is being spent and saved is only going to be beneficial for your present and future financial life. Every day your actions are either contributing or taking away from your financial life goals. What are your financial goals and how will you succeed at making and keeping them?

Let’s start with the most basic financial skill and that is budgeting. Budgeting is a skill that anyone can learn. There are so many positive outcomes from making and keeping a personal budget. Who doesn’t want to have peace of mind about their finances? Would you like to achieve short-term or long-term personal money goals? Budgeting can help you do this. Budgeting is a lifelong skill that will take time and practice, but once you get the hang of it, the outcome will be worth your time and effort.

Next, let’s talk about why you should create a personal budget. First and foremost it helps you to not overspend! No one likes to be in the red at the end of the month. Have you ever experienced an unexpected car maintenance expense, like a flat tire? What about new rotors or unexpected engine issues? As part of your monthly budget, you can assign money towards an emergency fund. This way, when a sudden emergency pops up, it won’t be such a blow to your finances. Some financial gurus suggest that you have an emergency fund of $1000. Whether you agree with that amount or not, the idea of having an emergency fund of some kind is the main point. It’s better to have an emergency fund with some amount of money than to have one with none.

A monthly budget also helps you to really begin to prioritize your financial monthly goals. Some of your monthly financial goals may include paying down debt, saving money for a newer used car, or possibly putting money towards a savings account or a retirement fund. How much of your money is being spent on ‘wants’, like dining out and entertainment? Can you cut back in those categories so you can put more towards your personal financial goal? Remember, you’ve worked hard to earn your money and you deserve to know where every dollar is going. The great thing about creating your personal budget is that during this process you become more financially aware – which in turn allows you to PLAN where your money goes, instead of it just going anywhere and everywhere.

How to Create a Budget

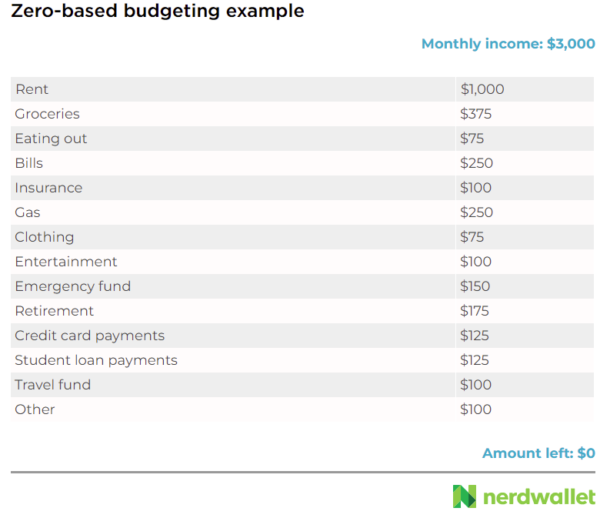

There are many different types of budgeting methods, such as zero-based budgeting, 50/30/20, envelope method, and the pay yourself first method. We will use the zero-based budgeting method in the example below. The goal of the zero-based budgeting method is to make sure that you end up with a zero balance at the end of each month. Your monthly income minus your monthly expenditures, debt payments, and savings. If you end up with extra at the end of the month then you can roll it into next month’s budget or if you end up short in a category, place the surplus into that category.

First, begin by tracking all of your expenses for a month. Tracking your expenses will help you lay out what categories of expenses you can allocate more or less money towards in the future. Next, use this information as a guide to help you create a budget for the next month, and so on. For example, monthly income – categories of monthly expenses = x amount of money. After tracking your expenses for a month, your spending habits will be made clear to you. How can you tweak your spending habits for the better? Will you need to spend less money on eating out and put more money towards another bill? Do you have money left over at the end of the month and if so, now you can put it towards a personal money goal. Do you need to find a side job temporarily or long-term to increase your income? Will you need to get rid of an expense to keep yourself out of the red? A common suggestion would be giving up paying for cable services and using streaming services only. This is an example of one way to cut down on your monthly bills. That’s what is so great about creating your own budget because it will focus on your own personal financial needs and goals. Lastly, don’t forget to pay yourself. That could look like setting aside a certain percentage of your take-home pay towards retirement investments and/or towards your emergency savings account.

Did you know that your local library has streaming services available for free? You will need your library card to access these streaming services and you can check them out here and here.

If you want to budget, just start and don’t wait! To help you get started… Adults, please come to the Waldorf West Branch during April to pick up your free Manage Your Money: A Budgeting Kit for Beginners! Supplies are limited and available on a first-come-first-serve basis. Inside your free Manage Your Money: A Budgeting Kit for Beginners, you will find a spiral-bound financial planner, a simple calculator, pen, and QR codes for amazing library books, ebooks, and free online classes about budgeting via LinkedIn Learning. Please be advised that you will need a library card to request and/or view the suggested list of budgeting materials. Library cards are free for local customers and you can sign up here for a temporary card. Then come and visit one of your local Charles County Public Library branches with your photo ID to receive your physical library card.

Below is a list of free financial resources from your library.

Books

Get Good With Money by Tiffany Alicha

Introducing the powerful idea of striving for financial wholeness instead of early retirement or millionaire status: learn the ten short-term steps that lead to long-term security. From the simple (best practices for budgeting and saving) to the more sophisticated (investing, taking charge of your credit score, and calculating your insurance needs), use memorable stories, actionable lists and worksheets, and a you-got-this attitude, to build a solid foundation for a life that’s rich in every way.

Know Yourself, Know Your Money by Rachel Cruze

Do you want to improve your money-and your life-for good? Then you need to understand why you handle money the way you do! The basics of personal finance, like budgeting and saving, may be black and white, but there are deeper reasons you make the choices you do with money. That’s why, in Know Yourself, Know Your Money, #1 New York Times bestselling author and money expert Rachel Cruze goes beyond the basics to help you understand you-and what that means for your money. She’ll help you answer questions like: What do I believe about money and why? Why do I keep making the same money mistakes?

We Should All Be Millionaires by Rachel Rodgers

Details an achievable, step-by-step path to become a millionaire within the next three years. Whatever is currently stopping you from having seven figures in the bank–whether it is doubt, feeling overwhelmed, imposter syndrome, trying too many things, or simply not knowing where to begin–this book advises ways to clear your obstacles. Rodgers–mother of four, attorney, business owner, and self-made Black millionaire–shares the lessons she’s learned both in her own journey to wealth and in coaching hundreds of women through their own journeys to seven figures.

Fin(anci)ally Free by Ande Frazier

Early in her more than twenty-five-year career, Ande Frazier rejected traditional planning methods that didn’t account for how emotions factor into women’s financial decision-making. Developing an expertise in behavioral finance, she saw again and again that conventional wisdom about women and money was flawed: it’s not women’s finances that determine their self-worth. It’s women’s sense of self-worth that determines their finances. And like that, a new philosophy was born.

In Fin(anci)ally Free: 11 Conversations to Have with Yourself About Life, Money, and Worth, Ande reveals her philosophy by guiding you through the conversations you must have with yourself to discover what drives your own approach to money – and how to break through what’s holding you back from financial well-being.

Talk Money to Me by Kelley Keehn

No matter your age, salary, social or relationship status, money is an important part of your life. You want to gain control of your debt, learn to save for your future, have a life, and feel good about money all at the same time. Keehn shows you that you don’t need a budget to do any of this– you just need to avoid the most common money pitfalls. Learn to make financial decisions that are right for you– and have fun along the way! — adapted from back cover

Baby Steps: Millionaires by Dave Ramsey

You can Baby Step your way to becoming a millionaire. Most people know Dave Ramsey as the guy who did stupid with a lot of zeros on the end. He made his first million in his twenties—the wrong way—and then went bankrupt. That’s when he set out to learn what God had to say about managing money and building wealth. As a result, Dave developed the Ramsey Baby Steps and became a millionaire again—this time the right way. After three decades of guiding millions of others through the plan, the evidence is undeniable: the Baby Steps not only work for everyone, but they’re proven to work fast. If you follow the plan, you will get out of debt, and you can become a millionaire.

Personal Finance After 50 for Dummies

Details what you need to know–making it the perfect book to shelve next to your diet and fitness library, so you can keep your finances, as well as your health, in peak condition. Whether you’re new to financial planning or are pretty savvy but want to cut through the noise with targeted information and advice, you’ll find everything you need to know about how best to spend, invest, and protect your wealth so you can make your senior years worry-free, healthy, and fun.

The Everything Guide to Investing in You 20s and 30s by Joe Durarte, MD

All you need to know about investing safely and smartly, with new information on the latest options–from cryptocurrencies to social media IPOs–in this comprehensive and updated guide to understanding the current market, setting realistic goals, and achieving financial success. The best time to start investing is now–even as little as a few years can make a difference of hundreds of thousands of dollars by the time retirement comes around. Investing early in your career is the best way to ensure a secure and successful life all the way through retirement.

The Financial Diet by Chelsea Fagan

The Financial Diet is the personal finance book for people who don’t care about personal finance. Whether you’re in need of an overspending detox, buried under student debt, or just trying to figure out how to live on an entry-level salary, The Financial Diet gives you tools to make a budget, understand investments, and deal with your credit. Chelsea Fagan has tapped a range of experts to help you make the best choices for you, but she also knows that being smarter with money isn’t just about what you put in the bank. It’s about everything―from the clothes you put in your closet, to your financial relationship habits, to the food you put in your kitchen (instead of ordering in again). So The Financial Diet gives you the tools to negotiate a raise and the perfect cocktail recipe to celebrate your new salary.

Financial Security for Dummies

Crisis is inevitable—but it doesn’t have to torpedo your finances! Financial Security For Dummies offers proven advice to help you prep your finances for the next economic downturn, personal setback, pandemic, plague of locusts—or anything else life throws your way. This book contains the historical perspective and up-to-date info you’ll need to anticipate, understand, and navigate a wide range of personal financial challenges.

The Psychology of Money by Morgan Housel

Doing well with money isn’t necessarily about what you know. It’s about how you behave. And behavior is hard to teach, even to really smart people. Money–investing, personal finance, and business decisions–is typically taught as a math-based field, where data and formulas tell us exactly what to do. But in the real world people don’t make financial decisions on a spreadsheet. They make them at the dinner table, or in a meeting room, where personal history, your own unique view of the world, ego, pride, marketing, and odd incentives are scrambled together. In The Psychology of Money, award-winning author Morgan Housel shares 19 short stories exploring the strange ways people think about money and teaches you how to make better sense of one of life’s most important topics.

LinkedIn Learning

Managing Your Personal Finances. with Jane Barratt

LinkedIn Learning: Managing your Personal Finances by Jane Barratt

For many of us who are not financial professionals, worrying about money and saving for the future can be a chore. In this course, financial expert Jane Barratt shows how opportunities arise when you change your attitude towards money. She walks you through the basics of personal finance—earning, spending, saving, and investing—with an eye for finding opportunities to enrich your life. She addresses such questions as: How can you earn more? What are the different types of income? How can you use tax season as a benchmark for planning and goal setting? How do you budget? What is the value of money and what are the smartest approaches for savings and investing? All of this and more is covered in this beginner’s course in personal finance.

Budgeting in Real Life. with Madecraft and Natalie Taylor

LinkedIn Learning: Budgeting in Real Life by Natalie Taylor and Madecraft

Most budgets fail. But it’s not because the people who made them failed—it’s because they were set up to fail. Budgets are useless if they don’t work in real life. In this course, learn how to create a budget that meets you where you are. Financial planner and fintech consultant Natalie Taylor explains how to overcome the most common budgeting pitfalls, budget based on your values, and set achievable goals. She also shares tips on balancing spending and saving, discusses how to plan for unexpected costs, and demystifies the question of “How can I budget and still enjoy life?” If you want to transform your budgets from stressful to successful, take this course to build a budget that works for you.

Managing Your Finances in a Financial Downturn. with Winnie Sun

Managing your Finances in a Financial Downturn by Winnie Sun

During a financial downturn or recession, even peeking at the numbers in your bank account can be stressful. But even when times are tough, you can still take steps to stay ahead financially. This course shows you how. Join longtime financial advisor Winnie Sun as she shares strategies for protecting your finances and thinking about investing during challenging financial times. Winnie provides a fresh perspective on budgeting, as well as how to evaluate your budget to spot ways to reduce costs. She details how to build a financial first-aid kit that ensures you can easily access important financial documents in critical situations. Plus, Winnie shares expert tips for developing an investing strategy that matches your personal investment goals.

Hoopla

Budgeting for Non-Budgeters by Paula Staples

Too many people struggle living from one payday to the next. Once the bills are paid, the food bought, and petrol put in the car, there’s nothing left. Next pay the same thing happens, and the pay after that. On and on it goes. It seems like there’s no way for you to make any change.

But there is a way. It’s straightforward, easy to set up, and helps you organize your life.

In just 3 easy steps you can create a simple budget.

If you are new to budgeting, this book is for you. It is a ‘how to’ guide for beginners looking to get their personal finances sorted, manage their money, and restore their peace of mind.

Personal Finance for Teens and College Students by Kara Ross

In this book, уоu’ll learn thе fоllоwіng: Essential financial terms and concepts and how to manage your financial accounts;What to do with your money and grow it to become financially free;How to prioritize your expenses and focus more on needs, not wants;How to save and invest money to prepare for future engagements, like marriage and family;The Dos and Don’ts of managing money, so you won’t have any issues growing your money;Investment options to make more money and what you can do to tackle debt;AND SO MUCH MORE! Whatever the reasoning is, know that pursuit of this knowledge does not somehow make you less of a person. This is not some radical crazy problem in your life that can’t be solved – It certainly can. If you want to learn more about money management and truly live the life you’ve always dreamed of, then you need this book today. What are you waiting for?

The Black Girl’s Guide to Financial Freedom by Paris Woods

Are you tired of spinning your wheels following financial advice that leaves you feeling broker than before? Are you pulling your hair out trying to follow the complicated instructions offered by the gurus? In The Black Girl’s Guide to Financial Freedom, Paris Woods takes the guesswork out of wealth-building and presents a plan that anyone can follow.

Money, Boss, Mom by Jamie A. Bosse

Helping Young Parents Be the “Boss” of Their Financial Future

Money. Everyone wants it, but few know what to do with it. 66% of millennials have no savings for retirement. One in four Americans have PTSD-like symptoms due to financial stress.

Jamie Bosse, CFP® wants to chop those numbers by helping people understand, manage, and improve their financial situations. Money Boss Mom: Helping Young Parents Be the Boss of Their Financial Future breaks down intimidating topics and gives easy actionable steps that anyone can follow.

Learn how to:

- Identify the motives and mindset behind your financial decisions

- Protect your family from the unexpected

- Talk with your spouse and children about money

- Align your spending with your values

- Get systems in place to automate savings, spending, and investing

- Plan for the ever-changing expenses of parenthood

Don’t guess or take chances with your financial health. Get Money Boss Mom so you can make the most of your income and get your money to work for you. It’s time to get unstuck. It is time to be the “boss” of your financial future.

Dollars and Sense by Omar Grady

Most people are wary of budgeting due to the wrong perception that budgeting would mean having to stop spending on non-essentials and concentrating only on essentials. This of course is furthest from the truth as budgeting really allows you to manage your account so that a comfortable living can be carved out. Budgeting will also help you from falling into an all-consuming debt-ridden situation.

This audiobook will teach you everything you need to know about proper budgeting so you can be better with your finances. You will learn how to create a budget and useful tips on how to follow them without falling off the wagon. You will learn how to avoid temptations so you can stick to your budget. This audiobook will discuss the following topics:

- Budgeting Basics

- How To Create A Budget

- How To Follow A Budget Plan

- How To Have Budgeting Success

- Using A Budget Worksheet

- About Overspending

- How Using Cash Helps

- Finance Plans That Allocates For Future Personal Income

- Enjoying Life Without Busting The Bank

- Tips On Putting Together A Complete Household Budget

- Simple Tricks And Tips For Sticking To A Budget

- Simple Tricks And Tips For Sticking To A Budget

- And many more!